Salesforce and Financial Services: Revolutionizing Customer Relationships and Business Growth

Get a Free Salesforce Consultation

KeyNode Solutions, a leading Salesforce Consulting Partner with clients around the globe, has helped an extensive number of companies in the financial services sector navigate the powerful use of the world’s #1 CRM.

KeyNode Solutions, a leading Salesforce Consulting Partner with clients around the globe, has helped an extensive number of companies in the financial services sector navigate the powerful use of the world’s #1 CRM.

In this article we explore how Salesforce is transforming the financial services industry, with a focus on its core features, benefits and specific applications in wealth management, retail banking, insurance and other financial sectors.

Salesforce and Financial Services: Revolutionizing Customer Relationships and Business Growth

KeyNode Solutions, a leading Salesforce Consulting Partner with clients around the globe, has helped an extensive number of companies in the financial services sector navigate the powerful use of the world’s #1 CRM.

In this article we explore how Salesforce is transforming the financial services industry, with a focus on its core features, benefits and specific applications in wealth management, retail banking, insurance and other financial sectors.

Get a Free Salesforce Consultation

The Role of CRM in Financial Services

CRM systems have been around for decades, originally designed to help companies track and manage their interactions with customers. However, as the financial services industry has become more complex and customer-centric, the role of a CRM has evolved. Today’s CRM solutions go beyond simple contact management—they are integral to understanding customer needs, improving service delivery, enhancing collaboration and driving business performance.

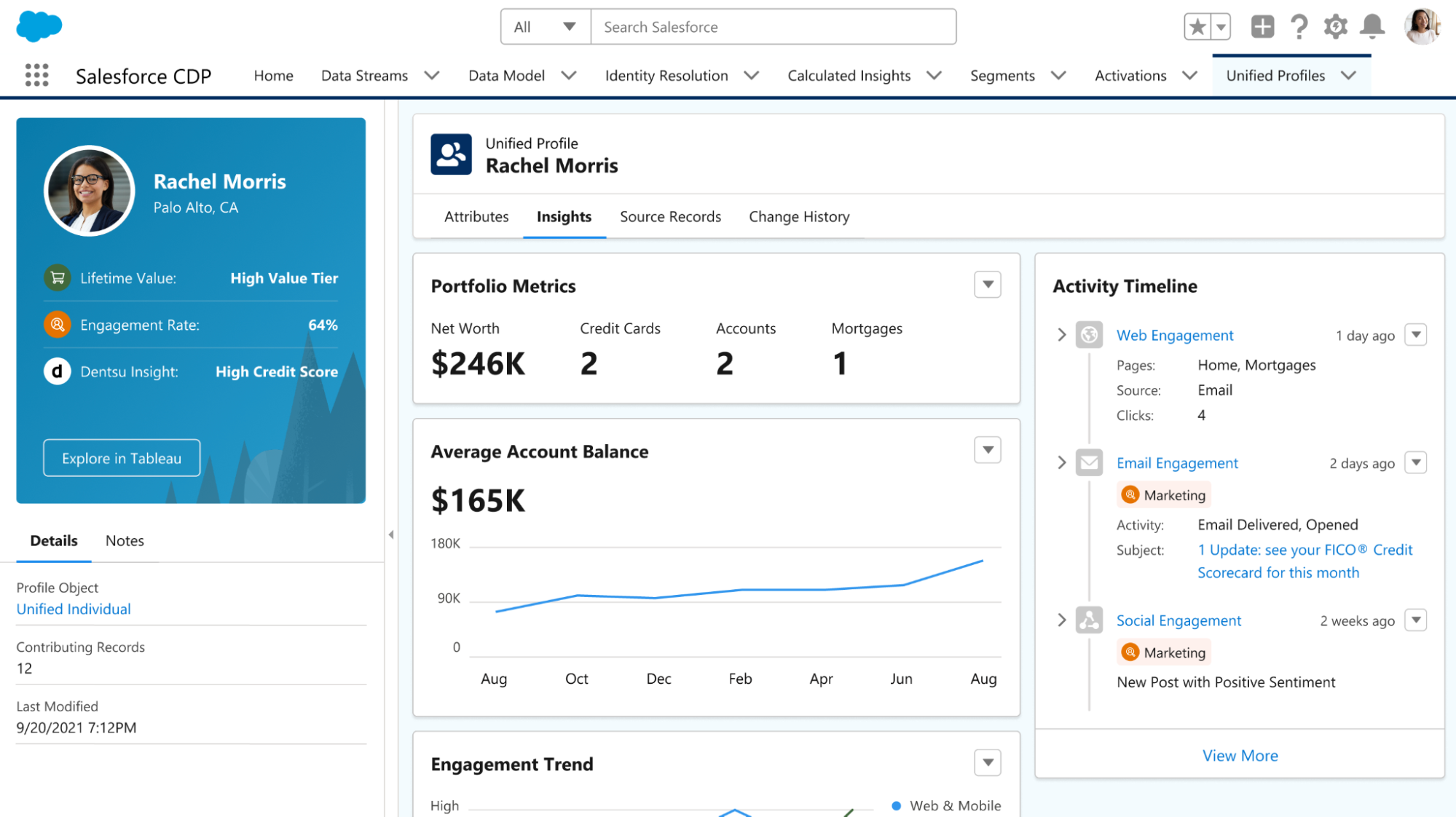

For financial institutions, CRM platforms like Salesforce offer a centralized, 360-degree view of the customer, enabling more meaningful interactions across all touchpoints. With Salesforce’s world-class CRM, financial institutions can collect and analyze customer data, segment their client base, personalize offerings, automate processes and ensure compliance, all while delivering high-quality, secure customer service.

Key Features of Salesforce for Financial Services

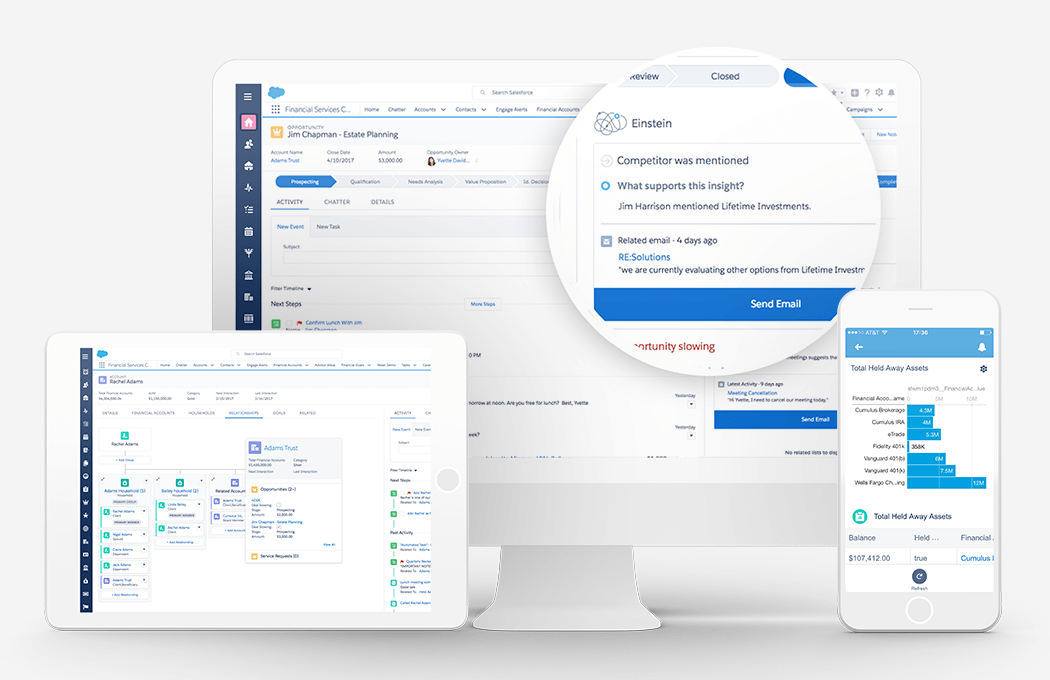

Salesforce is a cloud-based CRM platform that provides a comprehensive set of tools and features. Salesforce Financial Services Cloud is a specialized component designed specifically for the financial services industry. It includes a range of features and functionalities tailored to the unique needs of banks, insurance companies and wealth management firms. As a combination these two elements provide key features that make it particularly well-suited for the financial services industry.

1. Customer 360

The cornerstone of Salesforce is its ability to create a unified view of each customer. This single, comprehensive record aggregates data from across the organization, including interactions, transactions, preferences and history. In the financial services sector, this means a complete view of a client’s accounts, assets, investments, interactions with advisors and any past service requests. This holistic view enables financial institutions to provide highly personalized services and anticipate customer needs.

The cornerstone of Salesforce is its ability to create a unified view of each customer. This single, comprehensive record aggregates data from across the organization, including interactions, transactions, preferences and history. In the financial services sector, this means a complete view of a client’s accounts, assets, investments, interactions with advisors and any past service requests. This holistic view enables financial institutions to provide highly personalized services and anticipate customer needs.

2. AI-Powered Insights with Einstein Analytics

Salesforce includes Einstein AI, which provides advanced analytics and predictive insights. This feature is particularly beneficial for financial services companies that rely heavily on data to make informed decisions. By analyzing customer data, transaction patterns and market trends, Einstein can help financial advisors and institutions predict customer behaviors, offer personalized product recommendations and identify potential sales opportunities or risks.

3. Sales and Service Automation

Automation is a key benefit of Salesforce. Routine tasks such as data entry, lead routing, follow-up reminders and customer communications can be automated, freeing up time for financial professionals to focus on more value-added activities. For example, Salesforce’s Service Cloud automates case management, allowing customer service teams to quickly resolve issues. Similarly, Sales Cloud offers automation tools that streamline lead management, sales forecasting and pipeline management.

4. Mobile Accessibility

Salesforce is mobile-first, meaning that financial professionals can access customer data, track interactions and manage cases on-the-go via mobile apps. This is especially useful for wealth managers, financial advisors and insurance agents who need to stay connected with clients and prospects while out of the office. The Salesforce mobile app is available for both iPhone and Android and enables real-time updates and responsiveness, improving customer satisfaction.

Salesforce is mobile-first, meaning that financial professionals can access customer data, track interactions and manage cases on-the-go via mobile apps. This is especially useful for wealth managers, financial advisors and insurance agents who need to stay connected with clients and prospects while out of the office. The Salesforce mobile app is available for both iPhone and Android and enables real-time updates and responsiveness, improving customer satisfaction.

5. Integration with Third-Party Applications

Salesforce offers a range of pre-built integrations with third-party financial services applications, such as loan origination services, payment processors, accounting software, portfolio management tools and other. This flexibility allows financial institutions to tailor Salesforce to their unique needs and ensure smooth interoperability between systems. For instance, a bank could integrate Salesforce with its core banking platform to access real-time transaction data or link Salesforce to a financial planning tool for better client advice.

6. Compliance and Security

Given the strict regulatory environment in the financial services industry, Salesforce is designed with compliance and security in mind. It provides tools to help institutions stay compliant with data protection regulations, including Europe’s GDPR and the United States’ SEC rules. Salesforce’s secure cloud infrastructure ensures that customer data is encrypted, protected and stored in compliance with the highest industry standards. Financial Services Cloud includes features that help financial institutions comply with complex regulations, such as Know Your Customer (KYC) and Anti-Money Laundering (AML). This ensures that organizations can operate with confidence and avoid costly fines and penalties.

Given the strict regulatory environment in the financial services industry, Salesforce is designed with compliance and security in mind. It provides tools to help institutions stay compliant with data protection regulations, including Europe’s GDPR and the United States’ SEC rules. Salesforce’s secure cloud infrastructure ensures that customer data is encrypted, protected and stored in compliance with the highest industry standards. Financial Services Cloud includes features that help financial institutions comply with complex regulations, such as Know Your Customer (KYC) and Anti-Money Laundering (AML). This ensures that organizations can operate with confidence and avoid costly fines and penalties.

How Salesforce Is Impacting Financial Services

1. Wealth Management

In the wealth management sector, clients expect highly personalized service and advice tailored to their financial goals and risk tolerance. Salesforce enables wealth management firms to enhance customer relationships by providing financial advisors with real-time access to comprehensive customer profiles, including portfolio performance, risk assessments and goals.

With Salesforce’s AI-driven tools, advisors can proactively identify potential risks, opportunities and new investment products that might be suitable for each client. Additionally, Salesforce’s integration with financial planning software allows wealth managers to offer dynamic, goal-based financial planning services. These insights enable wealth management firms to deliver more value to their clients, strengthen relationships and improve client retention.

2. Retail Banking

In retail banking, customers expect a seamless, omnichannel experience that allows them to manage their finances across various channels, from mobile apps to in-branch services. Salesforce supports retail banks by centralizing customer data and providing a personalized, unified experience across all channels. Banks can track customer interactions, identify cross-sell and up-sell opportunities and provide tailored product offerings, such as loans, mortgages, or credit cards, based on individual customer profiles.

Salesforce’s Service Cloud also enables retail banks to improve customer service by automating case management and providing agents with instant access to relevant customer information. This leads to faster resolution times and a better overall experience for customers.

3. Insurance

In the insurance industry, Salesforce can help firms better understand policyholders and potential clients, streamline the underwriting process and offer more personalized coverage options. Insurers can create detailed customer profiles that include policy history, claims data and interactions with agents. With this information, agents can offer personalized product recommendations, improving the chances of securing a new client.

Furthermore, Salesforce can automate key processes like claims processing and policy renewals. With AI-driven insights, insurance companies can identify at-risk clients and take proactive steps to retain them, such as offering policy upgrades or discounts.

4. Commercial Banking

Commercial banks also benefit from Salesforce’s solutions by improving the management of relationships with corporate clients. Salesforce enables commercial bankers to track key accounts, manage complex transactions and anticipate the needs of corporate clients. By centralizing account information and providing a 360-degree view of each relationship, Salesforce makes it easier for commercial bankers to offer tailored products such as business loans, lines of credit and cash management solutions.

5. Regulatory Compliance and Risk Management

The financial services industry is highly regulated and maintaining compliance is crucial. Salesforce helps organizations stay compliant by tracking and managing compliance tasks, automating reporting processes and ensuring that all customer data is stored securely and in accordance with industry regulations. For example, Salesforce allows financial services firms to track client consent for communications or disclosures, ensuring compliance with regulations like the General Data Protection Regulation (GDPR) or the Know Your Customer (KYC) requirements.

6. Customer Retention and Cross-Selling

Salesforce CRM enables financial institutions to identify opportunities for cross-selling and upselling by analyzing customer data and transaction history. Financial advisors, for example, can use this information to recommend additional products that meet the evolving needs of their clients, such as estate planning services, additional insurance coverage or new investment options. By leveraging customer insights, Salesforce helps financial institutions drive growth while also improving customer satisfaction and retention.

The Salesforce Revolution

The financial services industry is undergoing a digital transformation and Salesforce is at the forefront of this revolution. By providing a comprehensive set of tools that enhance customer engagement, streamline operations and drive growth, Salesforce is empowering financial institutions to meet the demands of today’s tech-savvy and expectations-driven customers. With its AI-driven insights, automation capabilities and a 360-degree view of the customer, Salesforce is helping banks, wealth management firms, insurance companies and other financial services organizations provide a higher level of service and achieve greater business success.

As financial services firms continue to adapt to the changing landscape, Salesforce CRM will remain a key enabler of growth, innovation and competitive advantage in the industry. Whether it’s delivering personalized customer experiences, improving operational efficiency, or ensuring regulatory compliance, Salesforce offers the tools that financial institutions need to thrive in an increasingly digital and customer-centric world.

This is a critical time for financial services organizations to leverage Salesforce and its products. To learn more how the KeyNode Solutions team can help your business implement and maximize the power of Salesforce, the world’s #1 CRM, please call us at 1-858-215-5371 or email hello@keynodesolutions.com today!

Read What One Financial Services Client Says!

“I’ve used various Salesforce consultants in the past and by far KeyNode Solutions has been the best to work with. Their recommendations and execution of projects is spot on. Their organization and responsiveness truly stands out. Highly recommend their services.”

![]()

Robin A., COO of a Business & Consumer Loans Firm

Call us today at (858) 215-5371 or simply complete this form

KeyNode Solutions’ dedicated team of Salesforce-certified consultants takes pride in helping your financial services firm maximize the power of Salesforce to increase productivity, efficiency and revenue! Contact us today to learn more!

Your success is our 100% priority!